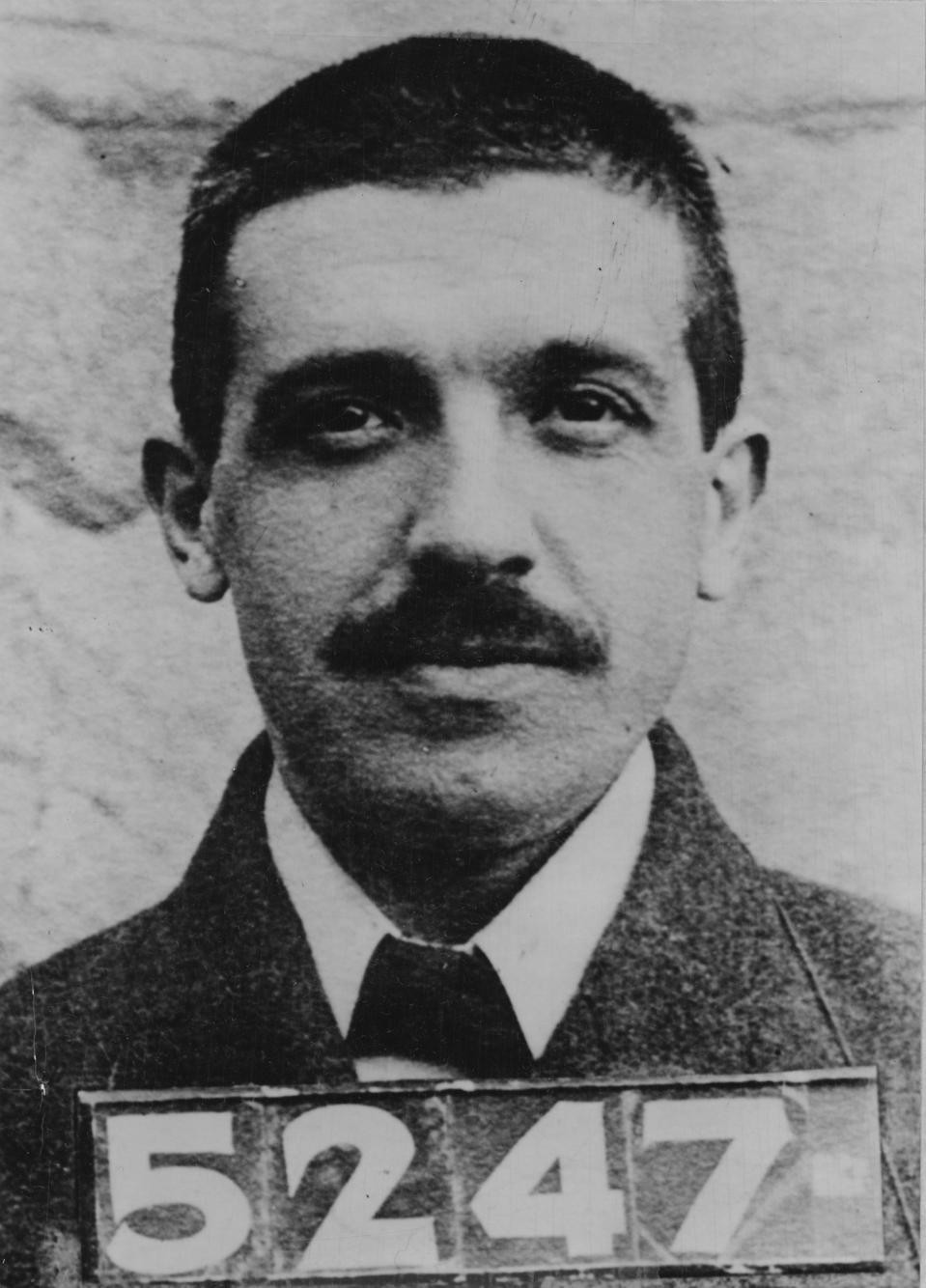

A police mug shot of Italian-born American swindler Charles Ponzi (1882 – 1949) after his arrest for … More

Charles Ponzi has been dead for 76 years but the scam that carries his name still lives on. On July 11th James Wellesley was arraigned and pleaded not guilty in Federal Court in New York City on wire fraud and money laundering charges related to what the FBI is calling a $99 million Ponzi scheme involving wine investment fraud.

According to the FBI, James Wellesley and his co-defendant Stephen Burton operated the scam between June of 2017 and February of 2019 during which time they represented to unwary investors that their company, Bordeaux Cellars brokered loans to high-net-worth wine collectors. These loans were purportedly secured by valuable wines such as Domaine de la Romanee-Conti and Chateau Lafleur stored by Bordeaux Cellars as collateral for the loans. Burton and Wellesley allegedly promised their targeted investor victims who they encountered at investment conferences both in the United States and abroad that they would receive returns of 48% annually through regular interest payments and, in fact, some of the early “investors” did receive some payments, but those payments, as is typical in a Ponzi scheme came from funds obtained from more recent victims of the scam.

The truth, according to the FBI, is that there were no loans and Wellesley and Burton held no valuable wine collections as collateral for the non-existent loans. Eventually when interest payments stopped, the scam investor victims in the Ponzi scheme became suspicious and following an investigation by the FBI both Burton and Wellesley were charged with wire fraud and money laundering. Both men fled the country with Burton being arrested in Morocco and extradited to the United States in 2023 and Wellesley arrested in the UK and extradited to the United States in early July 2025.

FBI agent Ricky Patel commented on the case, “James Wellesley and his co-conspirator are accused of masterminding their nearly $100 million international fraud scheme that exploited the unsuspecting public, including New Yorkers, for their own selfish enrichment.”

But what are the lessons of this scam for investors? What should these unsuspecting members of the public have done differently that might have prevented themselves from being scammed?

First and foremost, no one should ever invest in any investment that they do not truly understand, and no one should ever invest with any person or company without vetting that person or company. No one enjoys doing homework, but if the investors in this scam had done their homework they would have learned that the company Bordeaux Cellars had no significant legitimate business history In addition, if Bordeaux Cellars was a legitimate investment company, it would have been registered with the SEC, which it was not. Further, neither James Wellesley nor Stephen Burton had experience in wine finance.

Investors should have asked for an independent verification of the inventory of wines that Wellesley and Burton claimed to be holding as well as storage documentation from the wine storage facility where the wines were claimed to be held. Additionally, they should have confirmed any insurance policies on the rare wines or ownership records of the wines.

Finally, a telltale sign of an investment scam is a return that is unusually high, and the 48% annual return promised by Wellesley and Burton certainly should have been a cause for skepticism.

If convicted, both Wellesley and Burton face prison sentences of up to 20 years.