As states begin budget debates for state fiscal year (FY) 2027, many states are facing a more tenuous fiscal climate. Slowing revenue growth and heightened spending demands coupled with anticipated federal Medicaid cuts under the 2025 reconciliation law, changes to the Affordable Care Act (ACA) enhanced Marketplace subsidies, and economic changes are contributing to tighter budget conditions and fiscal uncertainty for states. Medicaid is often central to state fiscal decisions as it is simultaneously a significant spending item as well as the largest source of federal revenues for states.

States projected Medicaid enrollment to remain flat for FY 2026 in KFF’s 2025 budget survey of Medicaid officials and total Medicaid spending was expected to increase 7.9%, though there was substantial variation across states. States reported a variety of cost pressures including provider and managed care rate increases, greater enrollee health care needs, and increasing costs for long-term care, pharmacy benefits, and behavioral health services. Some states have already implemented Medicaid spending cuts to address recent budget challenges, and others may follow as they contend with budget gaps and prepare for the implementation of the Medicaid changes in the 2025 reconciliation law.

Now in January 2026, halfway through FY 2026, governors are beginning to release proposed budgets for state legislatures to consider for FY 2027. Most states will be adopting FY 2027 budgets this year and another 16 states enacted biennial budgets last year, though some of these states may adopt a supplemental budget for FY 2027. The state budget cycle in most states runs from July to June, and governors typically release their budget proposals early in the calendar year followed by a convening of the legislature to finalize and enact a budget. While most states have not yet released budget proposals, implementation of the 2025 reconciliation law will put pressure on state Medicaid programs and states such as Colorado and Idaho have already announced Medicaid cuts. Medicaid issues are also likely to intersect with broader health care coverage and affordability debates leading up to the mid-term elections in November 2026. There will be 39 gubernatorial elections (18 incumbent governors running for reelection and 21 incumbent governors who are either term-limited or not seeking reelection) and control of state legislative bodies could also be affected. This brief describes current state fiscal conditions as states begin FY 2027 budget debates and highlights key areas to watch for Medicaid policy changes as states respond to fiscal challenges and the 2025 reconciliation law.

State Fiscal Pressures

States are facing a more tenuous fiscal climate as they prepare for FY 2027 budget debates. In recent years, tax cuts combined with changes in inflation and consumer consumption patterns has led to slowing state revenue growth following a period of record-breaking revenue and expenditure growth for states after the initial pandemic-induced economic downturn (Figure 1). General fund spending has also slowed, and data show state rainy day fund capacity is also beginning to decline following all-time highs (though funds remain stronger than before the pandemic). States are also contending with increasing spending demands from Medicaid, employee health care, education, housing, and disaster response, though state fiscal conditions vary widely across states. Due to tightening budget conditions, some states have begun implementing more budget management strategies, like spending cuts or other cost containment measures.

Recent federal actions, including the passage of the 2025 reconciliation law, may intensify state budget pressures for FY 2027. States are preparing for significant policy changes and federal funding cuts in the 2025 reconciliation law, including tax code changes as well as Medicaid and SNAP cuts. The new law is expected to reduce federal Medicaid spending by $911 billion (or 14%) over the next decade, though the impact varies by state. States may offset some of the reductions with state funds, though the challenging fiscal climate and the magnitude of federal funding cuts in the new law may make it difficult. For example, states may consider filling in funding gaps created by losses in federal funding for Planned Parenthood or providing state funded coverage for lawfully present immigrants who lose health coverage due to new eligibility restrictions. Some states are also moving to subsidize ACA Marketplace premiums with state funds following the expiration of the enhanced subsidies. The expiration of the enhanced subsidies as well as federal workforce cuts, tariff changes, and shifts in economic conditions contribute to heightened fiscal uncertainty for states. While not expected to offset rural hospitals’ losses under the reconciliation law and funding amounts will vary, states will be receiving additional federal funding through a new rural health fund. Given state budget challenges and fiscal uncertainty, at least 14 states, including Arizona, California, Colorado, Delaware, Maryland, New Mexico, and Rhode Island, have already forecasted budget gaps for FY 2027.

State Medicaid Changes

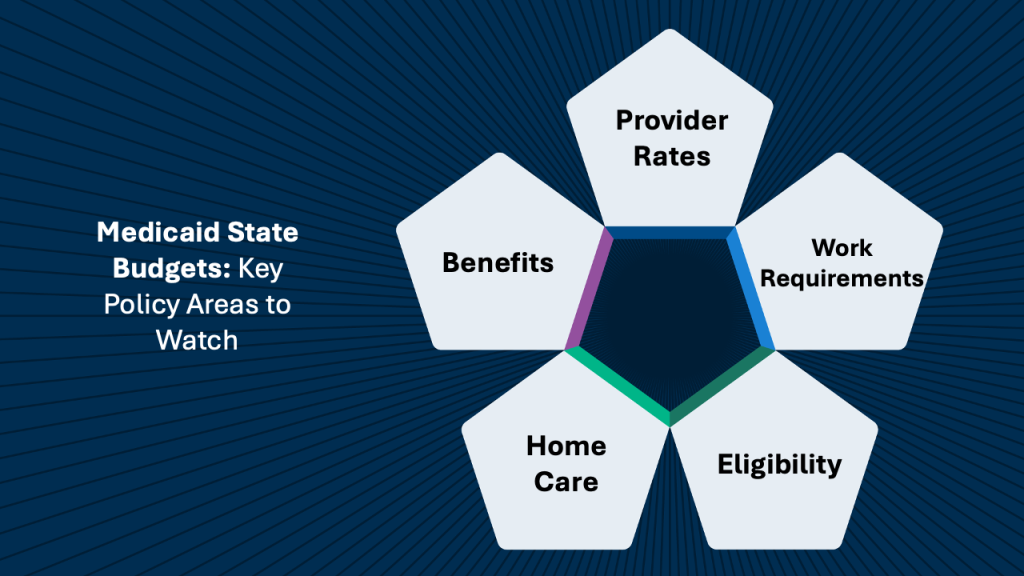

In response to mounting state budget pressures and the passage of the 2025 reconciliation law, FY 2027 state budget debates may include efforts to reduce Medicaid spending. Even though many provisions of the reconciliation law do not take effect immediately, a few states have already implemented Medicaid spending cuts for FY 2026 and, heading into the FY 2027 budget cycle, states may continue to propose Medicaid policy changes in key areas (Figure 2). This brief includes Medicaid changes from recently announced governors’ budget proposals, though most states have not yet released detailed budget proposals yet. The state budget landscape will likely continue to evolve as revenue forecasts and spending demands become clearer and as more states release their budgets. Given the timing and disparate impact of the reconciliation law across states as well as variation in state fiscal conditions, FY 2027 Medicaid policy changes will vary by state and some Medicaid cuts may not begin until FY 2028 or later.

Figure 2

Provider Rates

States have substantial flexibility to establish Medicaid provider reimbursement methodologies and amounts, especially within a fee-for-service (FFS) delivery system where a state Medicaid agency pays providers or groups of providers directly. Historically, during times of weak state revenue collections, states have typically turned to provider rate restrictions to contain costs. KFF’s 2025 Medicaid budget survey found that adopted FY 2026 budgets included more rate increases than cuts, but there was a notable uptick in states reporting provider rate restrictions compared to previous years. Some notable restrictions in FY 2026 included 4% across the board reductions for all provider types and services in Idaho, and a reversal of 1.6% across the board provider rate increases to address budget shortfalls in Colorado.

State budget pressures and the 2025 reconciliation law may result in additional rate cuts in FY 2027 budgets. While the 2025 reconciliation law did not directly make changes to how states set provider rates, the law imposes new limits on managed care state-directed payments for inpatient hospital and nursing facility services and new restrictions on states’ ability to generate Medicaid provider tax revenue. Some provider tax provisions in the new law have already been implemented, and some states may be anticipating the effect of future provider tax limits that will be phased on over time, which could exacerbate state budget challenges and result in reimbursement rate cuts. Some early FY 2027 governors’ budget proposals include provider rate restrictions: Colorado proposed reducing Medicaid provider rates to 85% of Medicare rates, along with rate reductions for certain home health, dental, behavioral health, and other services, and Idaho proposed extending their 4% provider rate reductions. Texas has also proposed reimbursement rate reductions for FY 2027 for substance use treatment facilities and durable medical equipment. North Carolina has not yet passed their biennial budget for FY 2026 and FY 2027; while this stalemate resulted in rate cuts that were eventually restored in FY 2026, the legislature may consider additional cuts as they finalize their budget.

Benefits

State Medicaid programs must cover a comprehensive set of “mandatory” benefits, including items and services typically excluded from traditional insurance, but may also cover a broad range of optional benefits. For example, all states cover prescription drugs as an optional benefit, and most states cover other optional services such as physical therapy, eyeglasses, and adult dental care. KFF’s 2025 Medicaid budget survey found that benefit expansions continued to far outweighed benefit restrictions and limitations in FY 2026 (consistent with prior survey years), particularly for behavioral health. However, some states had plans to restrict coverage of GLP-1s for obesity treatment, including California, New Hampshire, Pennsylvania, and South Carolina, which all eliminated coverage of GLP-1s for obesity treatment in January 2026, likely reflecting recent state budget challenges and fiscal uncertainty.

As states enter FY 2027 budget debates, it may be challenging to sustain recent benefit expansions and states may face increased pressure to cut or limit optional benefits. While the 2025 reconciliation law does not directly change Medicaid benefits, states may have to cut or limit optional benefits to offset federal funding cuts in the new law or respond to existing budget challenges. Colorado’s recently released governor’s budget proposal for FY 2027 includes capping dental benefits, and Rhode Island’s Medicaid program FY 2027 budget proposal considers ending GLP-1 coverage. Idaho governor’s budget proposal includes suggested cuts to dental, pharmacy, and various medical service benefits.

Home Care

Medicaid pays for almost 70% of all home care spending in the U.S., and most Medicaid home care is provided through optional services, giving states flexibility to manage costs. Most states use various mechanisms to limit home care spending under waiver programs, including caps on enrollment, total spending, and per-participant costs, as well as restrictions on specific services like personal care. Nearly a third of states reported planning to adopt new strategies in FY 2026 to contain home care costs, according to data from KFF’s 2025 survey of officials administering Medicaid home care programs.

State budget challenges and federal funding cuts in the 2025 reconciliation law could result in additional pressure to reduce optional home care services in FY 2027 budgets. The 2025 reconciliation law does not directly change home care benefits, but significant Medicaid spending on home care and the availability of mechanisms for limiting such spending could spur states to make home care cuts. When faced with fiscal pressures in the past, all states reduced spending on home care by either serving fewer people (40 states) and/or by cutting benefits or payment rates for long-term care providers (47 states). Recently released governors’ budget proposals from Colorado and Idaho include suggested cuts to home care services, although specifics of these proposals are not available and may evolve during the legislative process.

Eligibility and Work Requirements

Since the pandemic, many states have expanded Medicaid eligibility or taken steps to remove administrative barriers to enrollment for certain groups. States have also built on post-pandemic unwinding strategies to automate eligibility and renewal processes, improve communication with members, and reduce administrative barriers. However, in FY 2026, some states reduced Medicaid spending through eligibility restrictions, reflecting tighter budget conditions. As of January 2026, California reinstated asset limits for Medi-Cal eligibility for long-term care benefits for adults 65 and older or with a disability, and D.C. reduced Medicaid income limits to 138% of the federal poverty limit for certain enrollees. Some states have also rolled back state-funded health coverage programs that expand coverage to immigrants regardless of status. In addition, KFF’s 2025 Medicaid budget survey found that a few states planned to cancel or postpone one or more projects or initiatives due to uncertainty at the federal level, including federal waiver policy changes such as pre-release coverage for individuals who are incarcerated or continuous enrollment for children.

Upcoming FY 2027 budget debates may consider Medicaid eligibility restrictions to address state budget challenges. States will also begin the implementation of the 2025 reconciliation law’s Medicaid eligibility policy changes, including pausing implementation of some provisions in the Biden-era Eligibility and Enrollment Final Rule (that aimed to streamline complex processes), restricting Medicaid eligibility for certain immigrants, conducting more frequent eligibility redeterminations for ACA expansion adults, and imposing Medicaid work requirements for ACA expansion adults. Operationalizing these new policies will require significant changes to state eligibility systems and processes, which may displace staff, funding, and resources from implementing other Medicaid priorities. Increased costs associated with implementing the changes in addition to state budget pressures and federal funding cuts could mean more states consider restricting coverage of optional eligibility groups. For example, Idaho’s legislature has signaled that it may consider repealing the Medicaid expansion to address budget shortfalls.

The implementation of Medicaid work requirements may have a significant impact on state Medicaid program budgets and systems capacity in FY 2027. The 2025 reconciliation law requires states to implement work requirements for individuals enrolled through the ACA Medicaid expansion pathway or certain state waivers beginning January 1, 2027 (with the option for states to implement requirements earlier). The Congressional Budget Office (CBO) estimates that this requirement will have the largest effect on spending and coverage compared to other provisions, reducing federal Medicaid spending by $326 billion over ten years and resulting in 5.3 million more people who are uninsured. In KFF’s 2025 Medicaid budget survey, states reported a number of implementation challenges including the significant eligibility systems changes needed, the short timeframe, staff capacity concerns, and issues for applicants and enrollees. States also reported fiscal challenges tied to systems changes, hiring additional staff, and conducting outreach to enrollees. Even with implementation funds and federal matching payments for administrative costs, some states cited the increased costs of implementing work requirements on a short timeline as a concern, which may factor into FY 2027 budget debates. For example, among recently released FY 2027 governors’ proposed budgets, Utah includes $16.5 million, Colorado includes over $50 million, Kentucky includes $35.6 million, and Wyoming includes $7.4 million in funding for the new law’s Medicaid eligibility redetermination changes. In addition, some states are planning to move forward with work requirements before the federal deadline, which could have additional implications for state budgets. To date, Nebraska is the first state to announce it will implement early, starting May 1, 2026.