Business reporters, BBC News

Getty Images

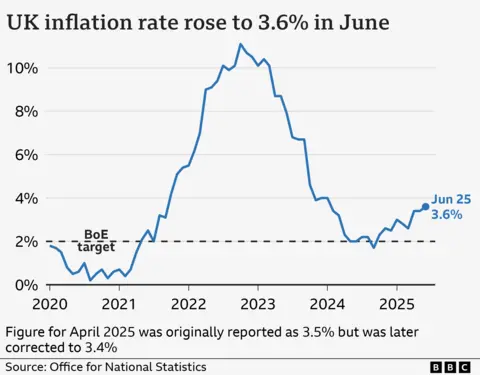

Getty ImagesPrices rose by more than expected in the year to June, pushing inflation to 3.6%, the highest it has been since January 2024.

Higher prices for food and clothing, air and rail fares – and a lower drop in fuel prices than this time last year – contributed to higher inflation, official figures show.

The rate at which prices increase matters to shoppers, whose money doesn’t go as far if goods and services are becoming rapidly more expensive.

Inflation remains much higher than the Bank of England’s target rate of 2%, but a cut in the cost of borrowing is still expected at next month’s rate-setting meeting.

The pace of price rises affects whether the Bank decides to raise or lower interest rates as higher rates can slow inflation by dampening economic activity.

The higher figure for June was unexpected, with economists having predicted the inflation rate would stay at the 3.4% it hit in April and May.

Yael Selfin, chief economist at KPMG UK, said persistent underlying pressures, including tax rises in April, meant inflation was likely to peak at 4% in the autumn.

Richard Heys, acting chief economist for the Office for National Statistics (ONS) said the largest contribution to June’s higher inflation came from transport.

While petrol and diesel are less expensive than they were a year ago, the price fell only slightly between May and June this year, compared to a larger fall in the same month last year.

Airfares, which can be volatile, were higher, specifically long-haul and European routes, the ONS said.

The rise in rail fares came from more expensive tickets on international routes.

‘Groceries add up’

Average wages have risen over the past year, by 5.2%, suggesting many people will not be worse off overall, but shoppers, particularly those on low incomes, are more affected by higher prices for daily staples such as food and petrol.

Alissia Mardlin, a bartender from London, said her rent in a shared flat was “extortionate” leaving her with little spare spending money.

“I eat sweetcorn and pasta,” she said, blaming the higher cost of living.

Private rents increased by 6.7% in the year to May, according to figures published by the ONS on Wednesday, a slightly slower pace than a month earlier.

House prices picked up again, rising by 3.9%.

Jonathan Ballantyne, a marketing manager from Bishop’s Stortford, told the BBC he had not noticed much change in his supermarket shop but was noticing a squeeze on petrol and energy costs.

“I’m more conscious of not driving places because I’m thinking what is it going to be costing,” he said.

Saul, who did not want to share his surname, said he had noticed coffee and beer getting more expensive, making people less likely to go out and socialise.

“Groceries add up massively,” he said. “Meal deals in supermarkets have gone up massively – they’ve increased by 50p since I can remember.”

Food prices rose at a rate of 4.5% in the year to June, the highest rate since February 2024 but well below the peak seen two years ago.

Food industry representatives said manufacturers were facing higher costs for key ingredients – such as chocolate, butter, coffee and meat – as well as higher energy and labour costs.

Bad for savers

The higher inflation figure follows news last week that the economy shrank unexpectedly in May.

Chancellor Rachel Reeves said she knew people were “still struggling with the cost of living” but said the government’s plans included putting “more money into people’s pockets”.

In her annual Mansion House speech on Tuesday, the chancellor emphasised the importance of growth to putting the UK back on track.

She said the financial industry it must change the “negative” narrative around savers putting money in stocks and shares.

Caitlyn Eastell, spokesperson for the personal finance publication, Moneyfactscompare.co.uk said higher inflation was potentially “bad news” for people’s wealth, as it is higher than the average return on savings accounts.

She advised them to “shop around” for the best savings returns.

Interest rates for savers may fall further if the Bank of England cuts borrowing costs as expected in August.

However, Andrew Sentance, a former member of the committee which sets interest rates, said on social media he believed it would be “irresponsible” to cut rates with inflation rising.

Other commentators, including KPMG’s Selfin, expect the higher rate to “reinforce the Bank of England’s cautious approach”.

Inflation currently remains well below the peaks it reached after Russia’s invasion of Ukraine, when higher energy prices pushed up costs across the board. In October 2022, it reached 11.1%.