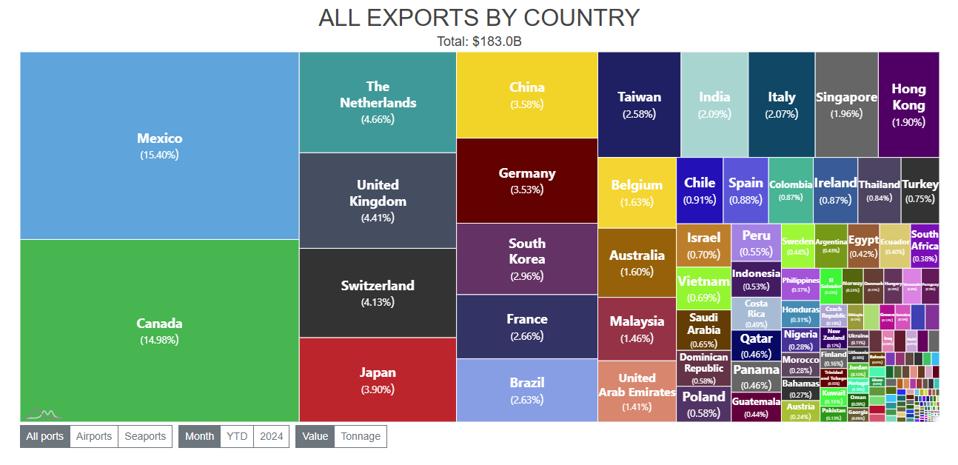

For the month of May, Mexico ranked first for U.S. exports, the latest data shows. It was the third … More

Mexico ranked first for U.S. exports for three of the first five months of 2025, a first, as the southern neighbor inched closer to being the top U.S. trade partner for imports, exports and total trade on an annual basis.

Not since 2006 has one country ranked first for exports, imports and total trade on an annual basis.

Until October of 2023, Mexico had never ranked first for U.S. exports in a single month. It then ranked first for two months in 2024. Now, it has ranked first three times in just the first five months of 2025, according to my review of the latest U.S. Census Bureau data available.

As far back as 1992, Canada had ranked first every other month. That’s as far back as the U.S. Census Bureau merchandise trade data goes, so my guess would be that Canada’s streak extended much further.

If Mexico were to rank first for U.S. exports for all of 2025 and repeat as the top source of U.S. imports, it would be the only country other than Canada to have ever done so. Canada did so from 1992 to 2006. Currently, Mexico ranks first for imports and total trade.

That ended in 2007, when China replaced Canada as the top importer into the United States, a rise made possible by its admission into the World Trade Organization. And then in 2023, Mexico replaced China as the No. 1 importer into the United States, its rise made possible by Trump’s imposition of steep tariffs on China during his first term.

For Mexico, the overall rise as a U.S. trade partner is marked by two significant events.

- The extension of the automotive supply chain integration between Canada and the United States to include Mexico when the North American Free Trade Agreement became law in 1992.

- President Trump’s trade war with China, begun in 2018, which, according to Census Bureau data, is shifting imports to Vietnam, Taiwan, Japan, South Korea and, to a lesser extent Mexico. (It’s suspected that China is skirting the tariffs by transshipping through these and other countries.)

With the passage of NAFTA, U.S. trade with Mexico accelerated. By 1999, Mexico had surpassed Japan to rank as the nation’s No. 2-ranked trade partner, behind Canada, a position it would hold until 2006.

Five years prior to that, China had gained entry to the World Trade Organization. In 2006, it supplanted Mexico to rank second among all U.S. trade partners on the strength of its imports into the United States. (It became second for imports within two years of entry into the WTO, in 2003.)

Then, in 2018, came the tariffs on China’s imports into the United States. It took five years, but in 2023, Mexico ranked first for imports into the United States, having overtaken both Canada and China. It had overtaken Canada, which had seen a lessened need for its oil after the United States increased oil production through fracking, in 2015.

For U.S. exports, Canada’s staying power has been longer-lasting, with Mexico the only country to have ever surpassed it – and only the one month in 2023 and two months in 2024 prior to this year.

This year, Mexico ranked first in January, April and May, though by the slimmest of margins over Canada – 0.42%, 0.35% and 0.90%, respectively.

On a year-to-date basis, however, Canada still ranks first for U.S. exports, though that is by an even slimmer margin: 0.13%.

U.S. exports to Mexico are up 1.02% on the year. But U.S. exports to Canada are down 3.73%, largely due to a steep decline in passenger vehicles, the top export, and motor vehicles parts, the second-ranked export.

U.S. exports to the world are up 4.94%, largely driven by gold shipments to Switzerland, generally a sign of investor skittishness about the U.S. economy.

Another change wrought by the Trump trade war with China was the elevation of Port Laredo to the No. 1 ranking among all U.S. airports, seaports and border crossings. For decades, the Port of Los Angeles had ranked first.

While the Port of Los Angeles is dominated by trade with China, so too is the Port Laredo dominated by trade with Mexico. This year, it is accounting for 39.48% of all U.S.-Mexico trade.

The Ysleta-Zaragoza Bridge outside of El Paso ranks second for U.S.-Mexico trade, with 11.86% of the total, followed by the Otay Mesa border crossing in California, with 6.92%, and two Texas border crossings, Pharr International Bridge (5.15%) and Eagle Pass (4.98%).

The Nogales, Ariz., and Santa Teresa, N.M. border crossings each account for slightly more than 4% each.

While automotive trade is what dominates U.S. trade with Mexico, it is not the primary factor this year.

Four U.S. exports to Mexico have increased more than $1 billion this year:

- Computer parts, up $3.01 billion, equal to 69.09%

- Computers, up $1.87 billion, equal to 99.61%

- Natural gas, up $1.55 billion, 57.16%

- Civilian aircraft and parts, up $1.14 billion, 45.95%

The computer and computer part exports are part of a back-and-forth supply chain centered around El Paso and its neighbor across the border, Ciudad Juarez. On the Mexico side of the border, Foxconn, Flex, Jabil and Dell all have operations and are benefitting from a boom in need for servers and related equipment being used to power the rapidly growing artificial intelligence industry’s needs.

The natural gas largely goes via pipelines near Brownsville, Pharr and Laredo, Texas, which are benefitting from the fracking within the state. The aircraft exports go largely through Port Laredo but also Del Rio, Texas.

Where from here? It remains to be seen whether Mexico can move ahead of Canada and become only the second country to lead the United States for exports, imports and total trade in a year. Certainly, the momentum seems to be on Mexico’s side.