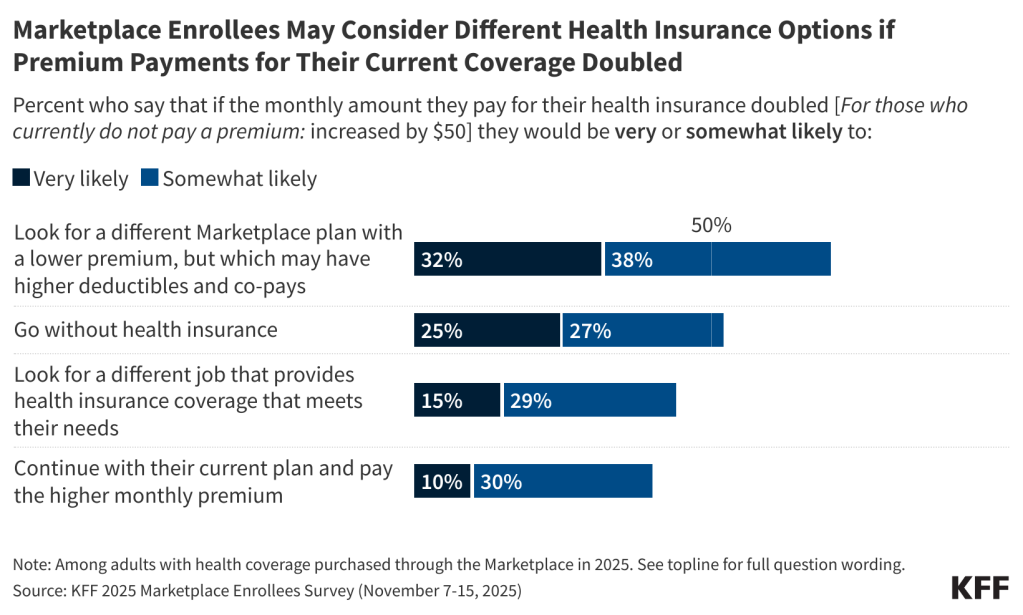

If the amount they pay in premiums doubled, about one in three enrollees in Affordable Care Act Marketplace health plans say they would be “very likely” to look for a lower-premium Marketplace plan (with higher deductibles and co-pays) and one in four would “very likely” go without insurance next year, finds a new survey of Marketplace enrollees fielded shortly after open enrollment began in the first weeks of November.

The survey captures the views and experiences of Marketplace enrollees as they weigh their coverage options for 2026, without the enhanced ACA credits or other policy changes that the Senate could debate this month. About 22 million of the 24 million Marketplace enrollees have benefited from the expiring tax credits, and without them, their premium payments are expected to rise an average of 114%, from $888 to $1,904 annually.

Nearly six in 10 enrollees (58%) say they would not be able to afford an increase of just $300 per year in the amount they pay for insurance without significantly disrupting their household finances. An additional one in five (20%) say they would not be able to afford a $1,000 per year increase in the amount they pay for health insurance without disrupting their finances.

If their total health care costs, including premiums, deductibles and other cost-sharing, increased by $1,000 next year, most Marketplace enrollees (67%) say they would likely cut spending on daily household needs, about half (54%) say they would likely to try to find another job or work extra hours, and four in 10 (41%) say they would likely skip or delay paying other bills. A third (34%) say they would take out a loan or increase their credit card debt.

“The poll shows the range of problems Marketplace enrollees will face if the enhanced tax credits are not extended in some form, and those problems will be the poster child of the struggles Americans are having with health care costs in the midterms if Republicans and Democrats cannot resolve their differences,” KFF President and CEO Drew Altman said.

It asked Marketplace enrollees to say how likely it was that they would take each of four different potential responses if the monthly premiums they pay doubled (or increased $50 a month for those who currently don’t pay a premium).

Open enrollment for Marketplace coverage began Nov. 1 and runs through Jan. 15 in most states, though consumers must enroll in a plan by Dec. 15 if they want their coverage to begin on Jan. 1. The vast majority of enrollees (89%) expect to make a decision by the end of this year, with many saying they have already made their decision about coverage for next year.