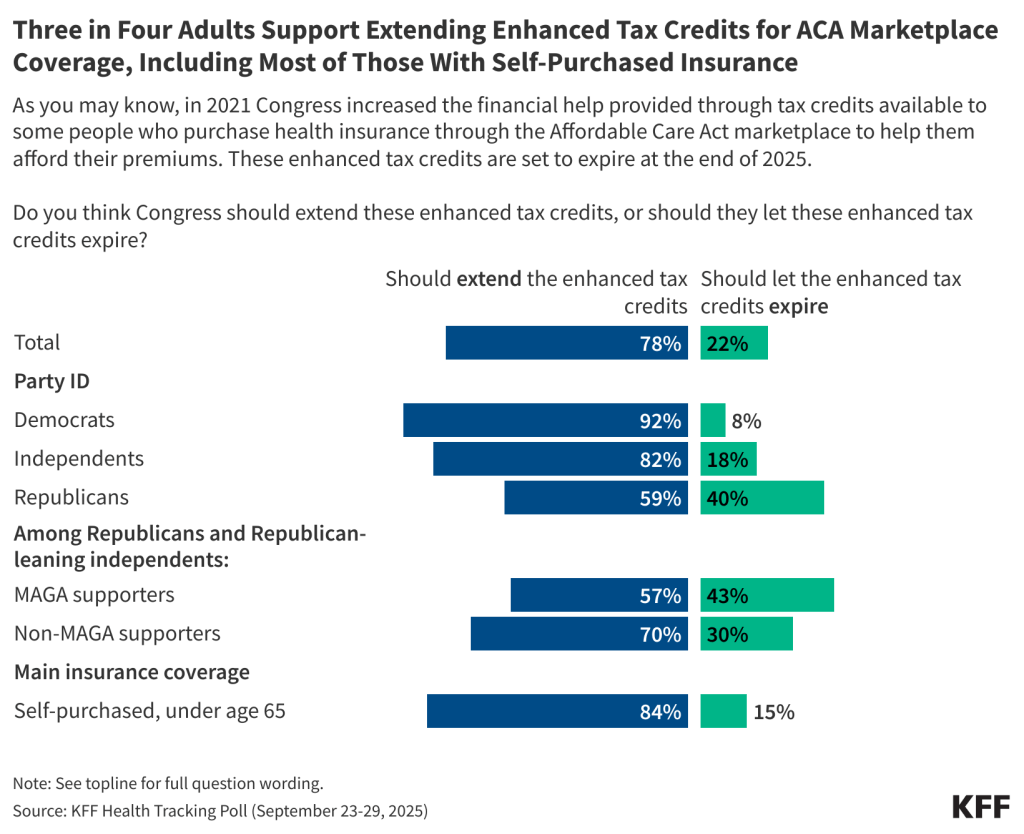

More than three-quarters (78%) of the public say they want Congress to extend the enhanced tax credits available to people with low and moderate incomes to make the health coverage purchased through the Affordable Care Act’s Marketplace more affordable, a new KFF Health Tracking Poll finds. That’s more than three times the share (22%) who say they want Congress to let the tax credits expire.

Most Republicans (59%) and “Make American Great Again” supporters (57%) favor extending the enhanced tax credits, which otherwise would expire at the end of the year and require Marketplace customers to pay much more in premiums to retain coverage. Larger majorities of Democrats (92%) and independents (82%) also support extending the enhanced tax credits, as do most people who buy their own health insurance, most of whom purchase through the Marketplace (84%).

The poll also tests the public’s response to arguments made by those who support and oppose extending the enhanced tax credits.

Among the public overall, more than eight in 10 say they would be concerned about the expirations of the tax credits if they heard that health insurance would become unaffordable for many people who buy their own coverage (86%), that about 4 million people would lose their health insurance coverage (86%), or that millions of people who work at small businesses or are self-employed would be directly impacted because they rely on the ACA Marketplace (85%).

In the other direction, a smaller majority (63%) say they would be concerned about extending the enhanced tax credits if they heard that it would require significant federal spending that would largely be paid by taxpayers. This includes a large majority of Republicans (83%) and most independents (61%).

When people who want to extend the enhanced tax credits were asked who deserves the most blame if they expire, roughly equal shares say President Trump (39%) and Republicans in Congress (37%), while a smaller share (22%) say that Democrats in Congress would deserve most of the blame.

“There is a hot debate in Washington about the looming ACA premium hikes, but our poll shows that most people in the marketplaces don’t know about them yet and are in for a shock when they learn about them in November,” KFF President and CEO Drew Altman said.

The poll was fielded just prior to the Oct. 1 federal government shutdown that was triggered in part by disagreements about whether, how and when to extend the expiring tax credits. A recent KFF analysis finds that losing that extra help would increase what Marketplace enrollees receiving financial assistance pay in premiums by an average of 114% – from $888 in 2025 to $1,904 next year.

The poll suggests that many Marketplace enrollees are going to be surprised by the jump in their premiums if the tax credits aren’t renewed in time for 2026 open enrollment period, which starts Nov. 1.

Among people who buy their own coverage (largely through the Marketplaces), about six in ten (58%) say they have heard just “a little” or “nothing at all” about the expiration of tax credits for eligible people with Marketplace coverage.

Among those who buy their own insurance, about a third (35%) expect their premiums to increase “a lot” next year. A quarter (25%) expect their premiums to rise “some,” another quarter (24%) expect their premiums to increase “a little,” and the rest (15%) don’t expect any increase.

When asked if they could afford health coverage if their premiums nearly doubled, seven in 10 (70%) of those who purchase their own insurance say they would not be able to afford the premiums without significantly disrupting their household finances, more than twice the share (30%) who say they could afford the higher premiums.

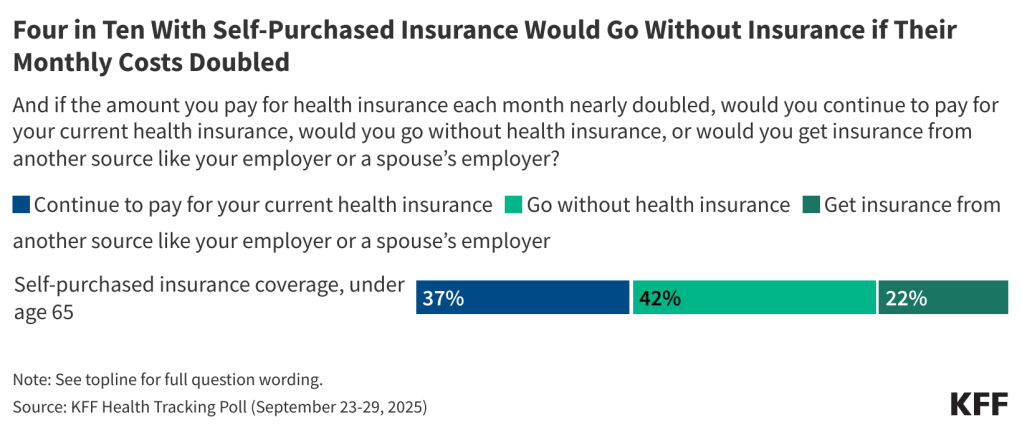

About four in 10 (42%) Marketplace enrollees say they would go without health insurance coverage if the amount they had to pay for health insurance each month nearly doubled. Similar shares (37%) say they would continue to pay for their current health insurance, while two in 10 (22%) say they would get insurance from another source, like an employer or a spouse’s employer.

Other findings include:

- Nearly two thirds (64%) of the public continue to hold favorable views of the Affordable Care Act overall, and a somewhat larger majority (70%) holds favorable views of the ACA’s Marketplaces. While two thirds (64%) of Republicans view the overall ACA unfavorably, most (59%) view the ACA Marketplaces themselves favorably.

- Most (61%) of the public holds unfavorable views of the tax and budget law enacted in July, also known as the “big beautiful bill,” while about four in 10 (38%) view it favorably. Large majorities of Democrats (88%) and independents (68%) view the law unfavorably, while similar majorities of Republicans (75%) and MAGA supporters (82%) view it favorably.

Designed and analyzed by public opinion researchers at KFF, this survey was conducted September 23-29, 2025, online and by telephone among a nationally representative sample of 1,334 U.S. adults in English and in Spanish. The margin of sampling error is plus or minus 3 percentage points for the full sample. For results based on other subgroups, the margin of sampling error may be higher.