Medicare is the federal health insurance program for 69 million people ages 65 and over and younger adults with long-term disabilities. The program helps to pay for many medical care services, including hospitalizations, physician visits, and prescription drugs, along with post-acute care, skilled nursing facility care, home health care, hospice care, and preventive services.

People with Medicare may choose to receive their Medicare benefits through traditional Medicare or through a Medicare Advantage plan, such as a health maintenance organization (HMO) or preferred provider organization (PPO), administered by a private health insurer. People who choose traditional Medicare can sign up for a separate Medicare Part D prescription drug plan for coverage of outpatient prescription drugs and may also consider purchasing a supplemental insurance policy (Medigap) to help with out-of-pockets costs if they do not have additional coverage from a former employer, union, or Medicaid. People who opt for Medicare Advantage can choose among dozens of Medicare Advantage plans, which include all services covered under Medicare Parts A and B, and typically include Part D prescription drug coverage as well.

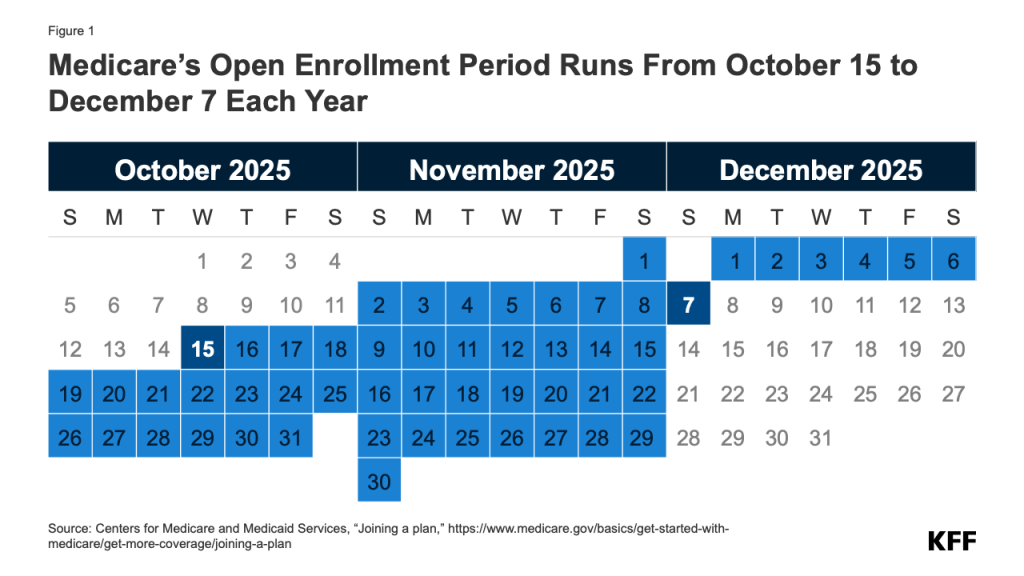

Each year, Medicare beneficiaries have an opportunity to make changes to how they receive their Medicare coverage during the nearly 8-week annual open enrollment period. This brief answers key questions about the Medicare open enrollment period and Medicare coverage options.

1. When is the Annual Medicare Open Enrollment Period?

The annual Medicare open enrollment period runs from October 15 to December 7 each year (Figure 1). During this time, people with Medicare can review features of Medicare plans offered in their area and make changes to their Medicare coverage, which go into effect on January 1 of the following year. These changes include switching from traditional Medicare to a Medicare Advantage plan (or vice versa), switching between Medicare Advantage plans, and electing or switching between Medicare Part D prescription drug plans.

2. What Changes Can Medicare Beneficiaries Make During the Annual Open Enrollment Period?

People in traditional Medicare can use the Medicare open enrollment period to enroll in a Medicare Part D prescription drug plan or switch between Part D plans. Traditional Medicare beneficiaries who did not sign up for a Part D plan during their initial enrollment period for Medicare can enroll in a Part D plan during the annual open enrollment period, though they may be subject to a late enrollment penalty if they did not have comparable prescription drug coverage from another plan before signing up for Part D. Traditional Medicare beneficiaries with Medicare Parts A and B can also use this time to switch from traditional Medicare into a Medicare Advantage plan, with or without Part D coverage.

People who are enrolled in a Medicare Advantage plan can use the Medicare open enrollment period to choose a different Medicare Advantage plan or switch to traditional Medicare. Medicare Advantage enrollees who switch to traditional Medicare can enroll in a Part D plan if they want outpatient prescription drug coverage, which is not covered under Medicare Parts A and B. (Beneficiaries may be subject to late enrollment penalties if they go without Part D drug coverage and don’t have other creditable coverage.) They may also consider purchasing a Medicare supplemental insurance policy (Medigap) if the option is available to them (see question 4 for details about Medigap and potential limits on enrollment).

Medicare beneficiaries are encouraged to review their current source of Medicare coverage during the annual open enrollment period and compare other options that are available where they live. Because an individual’s medical needs can change over the course of the year, and from one year to the next, this may influence their priorities when choosing how they want to get their Medicare benefits. Medicare Advantage and Medicare prescription drug plans typically change from one year to the next and may vary in many ways that could have implications for a person’s access to providers and costs. Despite this, nearly 7 in 10 (69%) Medicare beneficiaries did not compare their Medicare coverage options during a recent open enrollment period.

3. Are There Other Opportunities for Medicare Beneficiaries to Make Coverage Changes Outside of the Open Enrollment Period?

Medicare provides several different Special Enrollment Periods (SEPs) where Medicare beneficiaries can make certain changes to their coverage outside of the annual open enrollment period under certain circumstances. For example, beneficiaries who experience disruptions to existing coverage (such as a cross-county move or a loss of employer- or union-sponsored coverage) or loss of Medicaid eligibility may qualify for a SEP at any time of year.

As of 2025, people who are enrolled in both Medicare and Medicaid (i.e., dual-eligible individuals) or who qualify for the Medicare Part D Low-Income Subsidy program (also known as “Extra Help”), can make certain changes to their coverage once per month. Beneficiaries in these groups may use this monthly SEP to disenroll from a Medicare Advantage plan into traditional Medicare, enroll in a stand-alone Part D drug plan, or switch between Part D plans. However, they may not use the monthly SEP to enroll in Medicare Advantage or switch between Medicare Advantage plans, with the exception of individuals with full Medicaid benefits who are switching to a Fully Integrated Dually Eligible Special Needs Plan (FIDE SNP), a Highly Integrated Dually Eligible Special Needs Plan (HIDE SNP), or a coordination-only D-SNP that is an Applicable Integrated Plan (AIP) that is aligned with their Medicaid managed care enrollment. People living in nursing homes and certain other facilities may change their Medicare Advantage or Medicare Part D coverage once per month.

Medicare Advantage enrollees who wish to change plans or switch to traditional Medicare may do so between January 1 through March 31 each year, during the Medicare Advantage Open Enrollment Period. (This is in addition to the open enrollment period that runs from October 15 to December 7.) Additionally, those who have a Medicare Advantage or Medicare Part D plan with a 5-star quality rating available in their area may switch into a 5-star plan between December 8 and November 30 of the following year.

For 2026, people who select a Medicare Advantage plan based on inaccurate provider directory information in Medicare Plan Finder may qualify for a new, temporary SEP that allows them to switch to a different Medicare Advantage plan or return to traditional Medicare if they later discover that their preferred provider is not included in their plan’s network. This temporary SEP is currently limited to coverage decisions made for the 2026 plan year and runs for three months after the effective date of plan election. This is distinct from an existing SEP that allows Medicare Advantage enrollees to make changes to their coverage if their plan makes certain changes to its provider network that are deemed “significant,” such as terminating a large number of in-network providers. (See Q6 for more information about Medicare Advantage provider networks.)

The annual open enrollment period and other opportunities to switch coverage are distinct from the initial enrollment period for people who are newly enrolling in Medicare, which begins three months before a person’s 65th birthday and ends three months after it. For more information on initial enrollment, see KFF’s Medicare Open Enrollment FAQ.

Many Medicare beneficiaries have some form of additional coverage, such as a Medicare Supplemental Insurance policy (Medigap) or coverage offered by an employer or a union, that helps with Medicare’s cost-sharing requirements. Enrollment in these plans and programs is not tied to the open enrollment period, though beneficiaries may wish to take them into account when considering their options for Medicare coverage.

Medigap. People in traditional Medicare with both Part A and Part B can apply for a Medigap policy at any time of the year. Medigap policies are designed to help beneficiaries in traditional Medicare with Medicare’s deductibles and cost-sharing requirements and have standard benefits to allow for apples-to-apples comparisons across insurers. Traditional Medicare beneficiaries with a Medigap plan that covers most deductible and cost-sharing requirements may have lower out-of-pocket spending for Medicare-covered services than people with other coverage, including a Medicare Advantage plan. Medigap policies are designed to wrap around traditional Medicare, and do not work with Medicare Advantage. People enrolled in Medicare Advantage do not need (and can’t buy) a Medigap policy.

While Medigap insurers are required to issue policies to people age 65 or over, without regard to health status or diagnosed medical conditions when they first enroll in Medicare, those with pre-existing conditions may be denied a Medigap policy or face higher premiums in most states if they apply for Medigap coverage after their first six months of enrollment in Part B. People who disenroll from Medicare Advantage within 12 months of first enrolling in Medicare Advantage have a right to purchase a Medigap policy without regard to medical history, but after 12 months, they are not guaranteed Medigap coverage and may be denied a policy due to a pre-existing condition or face higher Medigap premiums if they are offered a policy.

Medigap guaranteed issue rights are different for people under age 65 who qualify for Medicare due to long-term disability. Federal law does not require Medigap insurers to sell a policy to people with Medicare under age 65, although several states do require insurers to offer at least one kind of Medigap policy to people under 65. Premiums for Medigap policies sold to people under age 65 are typically higher than policies sold to those age 65 or older. People under age 65 with disabilities who are already enrolled in Medicare will qualify for the 6-month Medigap open enrollment period when they turn 65 and become age eligible for Medicare. At this point, they can buy any Medigap policy they want without facing higher premiums or denials of coverage based on their existing medical conditions.

Employer-sponsored coverage. While employer-sponsored retiree health benefits are on the decline, more than 14.5 million people with Medicare have retiree health coverage (distinct from people with Medicare Part A only who continue to work and have health insurance through their current employer or a spouse’s current employer). Retiree health benefits may be designed to supplement either traditional Medicare or Medicare Advantage. Some employers that offer health benefits to retirees on Medicare offer these benefits exclusively through a Medicare Advantage plan. Beneficiaries with retiree health coverage offered exclusively through a Medicare Advantage plan may lose these benefits if they choose to switch to traditional Medicare during the annual open enrollment period. Similarly, employers may only offer a retiree health benefit that supplements traditional Medicare. If a person with such coverage switches from traditional Medicare to Medicare Advantage during an open enrollment period, they may lose their retiree health benefits. In fact, if a Medicare beneficiary drops their employer or union-sponsored retiree health benefits for any reason, they may not be able to get them back.

5. How Does Additional Support for Low-Income People Factor into Medicare Coverage Decisions?

Low-income Medicare beneficiaries who meet their states’ Medicaid eligibility criteria qualify for additional coverage of services through Medicaid that are not covered under Medicare, such as long-term services and supports. Additionally, Medicare beneficiaries with modest incomes may qualify for assistance with Medicare premiums and out-of-pocket costs from the Medicare Savings Programs (MSP) and Part D Low-Income Subsidy (LIS) if their income and assets are below certain amounts. Medicare beneficiaries who are eligible for Medicaid, the Medicare Savings Programs (MSPs), or Medicare Part D Low-Income Subsidies (LIS), but not yet enrolled in these programs, can enroll at any time of the year. This additional coverage and assistance may factor into how people choose to receive their Medicare benefits.

Medicaid. For people with Medicare who qualify for full Medicaid benefits, their choice of Medicare coverage can impact how they receive Medicaid benefits and the degree to which those benefits are coordinated with Medicare. In general, Medicaid wraps around Medicare coverage, with Medicare as the primary payer and Medicaid paying for costs and services not covered by Medicare. People who are eligible for both Medicare and Medicaid (dual-eligible individuals) can enroll in a Medicare Advantage plan designed for this population, such as a dual-eligible Special Needs Plan (SNP), and depending on the state and the plan, may experience a higher level of coordination of their benefits. Beginning in 2025, people who qualify for full Medicaid benefits can make certain changes to their Medicare coverage outside of the open enrollment period, up to once per month (see Q3 for further details).

Medicare Savings Programs. Through the Medicare Savings Programs (MSP), state Medicaid programs pay Medicare premiums and, in many cases, cost sharing for Medicare beneficiaries who have income and assets below certain amounts (though some states have lifted their income and/or asset thresholds above the federal limits). Specifically, states cover the Medicare Part B premium for people who qualify and may also provide assistance with Medicare deductibles and other cost-sharing requirements. People who receive MSP assistance and are enrolled in a Medicare Advantage plan may still have cost sharing associated with non-Medicare covered services offered by the plan. People who qualify for MSP but not full Medicaid benefits (sometimes referred to as “partial Medicaid benefits”) can also make certain changes to their coverage outside of the open enrollment period, up to once per month.

Part D Low-Income Subsidy. People who qualify for the Part D Low-Income Subsidy (LIS) receive varying levels of assistance toward their Part D prescription drug coverage premiums and cost sharing, depending on their income and asset levels. Dual-eligible individuals, people enrolled in the Medicare Savings Programs, and those who receive Supplemental Security Income payments from Social Security automatically qualify for LIS benefits, and Medicare automatically enrolls them into a stand-alone Part D drug plan in their area with a premium at or below a certain amount (the Low-Income Subsidy benchmark) if they do not choose a plan on their own. Other beneficiaries are subject to both an income and asset test and need to apply for the LIS through either the Social Security Administration or Medicaid. People who receive LIS assistance can select any Part D plan offered in their area, but if they enroll in a plan that is not a so-called “benchmark plan” (that is, plans available without a premium to enrollees receiving full LIS), or their current plan loses benchmark status, they may be required to pay some portion of their plan’s monthly premium, which would diminish the value of the premium subsidy. People who receive LIS can also make certain changes to their coverage outside of the open enrollment period, up to once per month.

6. How Do the Features of Traditional Medicare Compare to Those of Medicare Advantage?

Traditional Medicare and Medicare Advantage both provide coverage of all services included in Medicare Part A and Part B, but certain features, such as out-of-pocket costs, provider networks, and access to extra benefits vary between these two types of Medicare coverage. When deciding between traditional Medicare and Medicare Advantage, Medicare beneficiaries may want to consider a variety of factors, such as their own health and financial circumstances, preferences for how they get their medical care, which providers they see, and their prescription drug needs. These decisions may involve careful consideration of premiums, deductibles, cost sharing and out-of-pocket spending; extra benefits offered by Medicare Advantage plans; how the choice of coverage option may affect access to certain physicians, specialists, hospitals and pharmacies; rules related to prior authorization and referral requirements; and variations in coverage and costs for prescription drugs.

People may prefer traditional Medicare if they want the broadest possible access to doctors, hospitals and other health care providers. Traditional Medicare beneficiaries may see any provider that accepts Medicare and, if they are new to the provider, accepts new patients. People with traditional Medicare are not required to obtain a referral for specialists or mental health providers. Additionally, prior authorization is rarely required in traditional Medicare and only applies to a limited set of services. With traditional Medicare, people have the ability to choose among stand-alone prescription drug plans offered in their area, which tend to vary widely in terms of which drugs are covered and at what cost. (Beginning in 2026, a pilot initiative known as the Wasteful and Inappropriate Services Reduction (WISeR) model will test the use of prior authorization in traditional Medicare for a small set of outpatient services in six states. The WISeR model is limited to traditional Medicare, though most Medicare Advantage plans already require prior authorization for some services.)

People may prefer Medicare Advantage if they want extra benefits, such as coverage of some dental and vision services, and reduced cost sharing offered by these plans, often for no additional premium (other than the Part B premium). Additionally, Medicare Advantage plans are required to include a cap on out-of-pocket spending, providing some protection from catastrophic medical expenses. Medicare Advantage plans also offer the benefit of one-stop shopping (i.e., people who enroll have coverage under one plan and do not need to sign up for a separate Part D prescription drug plan or a Medigap policy to supplement traditional Medicare).

7. How do Medicare Advantage Plans Vary?

The average Medicare beneficiary can choose from 39 Medicare Advantage plans in 2026, including 32 Medicare Advantage plans with Part D coverage, though the average number of plan options varies widely across states (Figure 2). These plans vary across many dimensions, including premiums and out-of-pocket spending, provider networks, extra benefits, prior authorization and referral requirements, and prescription drug coverage. As a result, enrollees face different out-of-pocket costs, access to providers and pharmacies, and coverage of non-Medicare benefits (such as dental, vision and hearing) based on the Medicare Advantage plan they choose.

Premiums and out-of-pocket spending. Medicare Advantage enrollees may be charged a separate monthly premium (in addition to the Part B premium). In 2025, the average enrollment-weighted premium for Medicare Advantage plans was $13 per month, though three quarters (76%) of enrollees were in plans that charged no additional premium (apart from the Part B premium).

Medicare Advantage plans are generally prohibited from charging more than traditional Medicare, but vary in the deductibles, co-pays and co-insurance they require. For example, plans typically charge a daily co-pay for hospital stays, which vary both in the amount and the number of days for which they apply.

Medicare Advantage plans are required to include a cap on out-of-pocket expenses. In 2025, this cap may not exceed $9,350 for in-network services or $14,000 for all covered services. Most plans have an out-of-pocket limit below this cap, averaging $5,320 for in-network services and $9,547 for in-network and out-of-network services combined. Out-of-pocket limits only apply to services covered under Medicare Parts A and B.

Provider networks. Medicare Advantage plans are permitted to limit their provider networks, the size of which can vary considerably for both physicians and hospitals, depending on the plan and the county where it is offered. Medicare Advantage plans that include prescription drug coverage may also establish pharmacy networks or designate preferred pharmacies, where enrollees will have lower out-of-pocket costs. If a Medicare Advantage plan provides coverage of out-of-network providers, it may require higher cost sharing from enrollees for these services. For the 2026 plan year, the Medicare Plan Finder tool will incorporate searchable provider directories for Medicare Advantage plans. While these directories will initially include plan network information sourced from a third-party vendor, insurers will be required to provide regular updates to this information from January 2026 onward, including notifications within 30 days of any changes to a plan’s network and annual attestations that the listed directories are up to date.

Extra benefits. Medicare Advantage plans may choose to offer extra benefits not covered by traditional Medicare, such as some coverage of dental, vision, and hearing services. Virtually all Medicare Advantage enrollees are in a plan that offers extra benefits, including some coverage of eye exams and/or eyeglasses (more than 99%), dental care (98%), hearing exams and/or aids (95%), and a fitness benefit (94%). Additionally, a majority of Medicare Advantage enrollees are in plans that provide an allowance for over-the-counter items (79%) and meals following a hospital stay (70%). While extra benefits are common, the scope of coverage varies widely from plan to plan. For example, in 2021, more than half (59%) of Medicare Advantage enrollees were in a plan with a maximum dental benefit of $1,000 or less, while nearly one-third (30%) were in a plan with a limit between $2,000 and $5,000.

Prior authorization and referral requirements. Medicare Advantage plans may require enrollees to receive prior authorization before a service will be covered. In 2023, nearly 50 million prior authorization requests were submitted to insurers on behalf of Medicare Advantage enrollees, and in 2025, virtually all Medicare Advantage enrollees are in plans that require prior authorization for some services, such as inpatient hospital stays, diagnostic tests and procedures, or stays in a skilled nursing facility. Prior authorization may also be required for some services included in a plan’s extra benefits, such as hearing and eye exams or comprehensive dental services. In addition, Medicare Advantage plans may require enrollees to obtain a referral from a primary care provider in order to see a specialist or mental health provider.

Beginning in 2026, Medicare Advantage plans will be required to follow additional requirements when making prior authorization decisions. These include issuing decisions within a set timeframe (7 calendar days for standard requests or 72 hours for expedited requests), informing beneficiaries and providers of the specific reason a request is denied, and reporting certain information about their prior authorization processes on their public websites by March 31 each year, such as the share of requests that were approved, denied, or approved after appeal in the prior calendar year.

Prescription drug coverage. Medicare Advantage enrollees who want prescription drug coverage must choose a plan that offers this coverage, as they are not permitted to enroll in a stand-alone prescription drug plan while enrolled in Medicare Advantage. Medicare Advantage plans that include prescription drug coverage may also charge a drug deductible. Drug coverage in Medicare Advantage plans varies along the same dimensions as drug coverage in stand-alone Part D plans (described below).

8. How Do Part D Plans Vary?

Medicare beneficiaries have between 8 and 12 stand-alone Part D plans to choose from for 2026 (Figure 3) (in addition to a large number of Medicare Advantage drug plans, if they want to consider Medicare Advantage for all of their Medicare-covered benefits). For traditional Medicare beneficiaries who want to add Part D coverage, stand-alone Part D plans vary in terms of premiums, deductibles and cost sharing, the drugs that are covered and any utilization management restrictions that apply, and pharmacy networks. These differences can affect enrollees’ access to prescription drugs and out-of-pocket costs.

Premiums. People in traditional Medicare who are enrolled in a separate stand-alone Part D plan generally pay a monthly Part D premium unless they qualify for benefits through the Part D Low-Income Subsidy (LIS) program and are enrolled in a premium-free (benchmark) plan. In 2025, the average enrollment-weighted premium for stand-alone Part D plans was $39 per month. Changes to the Part D benefit in the Inflation Reduction Act, such as the cap on out-of-pocket drug spending for Part D enrollees ($2,100 in 2026), mean lower out-of-pocket costs for many Medicare beneficiaries but higher costs for Part D plan sponsors (see Q9 for further discussion of the Inflation Reduction Act).

Deductibles and cost sharing. Deductibles and cost-sharing requirements for prescription drug coverage vary across plans. In 2026, the standard deductible for Part D coverage is $615, but some plans charge a lower or no deductible. Plans generally impose a tier structure to define the cost-sharing amounts charged for different types of drugs. Plans typically charge lower cost-sharing amounts for generic drugs and preferred brands and higher amounts for non-preferred and specialty drugs, and charge a mix of flat dollar copayments and coinsurance (based on a percentage of a drug’s list price) for covered drugs. Separate cost-sharing rules now apply to insulin, where copays are capped at $35 per month, and adult vaccines covered under Part D, where no cost sharing can be charged, based on provisions in the Inflation Reduction Act of 2022.

Drugs covered and utilization management restrictions. Part D plans include a list of drugs they cover (also referred to as a plan’s formulary). In addition, plans impose utilization management restrictions on some covered prescription drugs, including prior authorization, quantity limits, and step therapy, which can affect beneficiaries’ access to medications. In 2025, Part D plans applied utilization management requirements to around half of all drugs covered on a plan’s formulary.

Pharmacy networks. Part D prescription drug plans may establish pharmacy networks or designate preferred pharmacies, where enrollees will have lower out-of-pocket costs.

9. What Changes Have Been Made to Medicare Eligibility Based on Immigration Status?

Prior to the tax and budget reconciliation law enacted in 2025, residents of the U.S. ages 65 or older, including citizens, permanent residents, and lawfully-present immigrants, were eligible for premium-free Medicare Part A if they had worked at least 40 quarters (10 years) in jobs where they or their spouses paid Medicare payroll taxes. Lawfully-present immigrants ages 65 or older without this work history could purchase Medicare Part A after residing legally in the U.S. for five continuous years. Lawfully-present immigrants under age 65 with long-term disabilities could also qualify for Medicare, provided they met the same eligibility requirements for Social Security Disability Insurance (SSDI) that apply to citizens. These requirements are based on work history, payment of Social Security taxes on income, and having enough years of Social Security taxes accumulated to equal between 20 and 40 work credits (5-10 years).

Starting in July 2025, Medicare eligibility is limited to U.S. citizens, permanent residents (i.e., green card holders), Cuban-Haitian entrants, and people residing under the Compacts of Free Association. Lawfully-present immigrants who don’t meet these criteria, such as refugees, asylees, and people with Temporary Protected Status, will no longer eligible for Medicare regardless of age or work history. Individuals with current Medicare coverage who do not fall in any of these categories will have their coverage terminated no later than January 2027.

10. What Resources are Available to Assist Medicare Beneficiaries in Understanding Their Coverage Options?

People with Medicare can learn more about Medicare coverage options and the features of different plan options by reviewing the Medicare & You handbook. In addition, people can review and compare the Medicare options available in their area by using the Medicare Plan Compare website, a searchable tool on the Medicare.gov website, by calling 1-800-MEDICARE (1-800-633-4227), or by contacting their local State Health Insurance Assistance Program (SHIP). SHIPs offer local, personalized counseling and assistance to people with Medicare and their families. Contact information for state SHIPs can be found by calling 877-839-2675 or by checking the listing provided on the Medicare.gov website.

Additionally, many people use insurance agents and brokers to navigate their coverage options. While independent agents and brokers can be helpful, they are typically financially compensated by private insurers for enrolling people in their plans, and often receive higher commissions if people choose a Medicare Advantage plan rather than remaining in traditional Medicare and purchasing a supplemental Medigap policy and stand-alone Part D plan.